Dmm Vs Floor Broker

In contrast nyse confers special advantages to its single dmm and floor brokers.

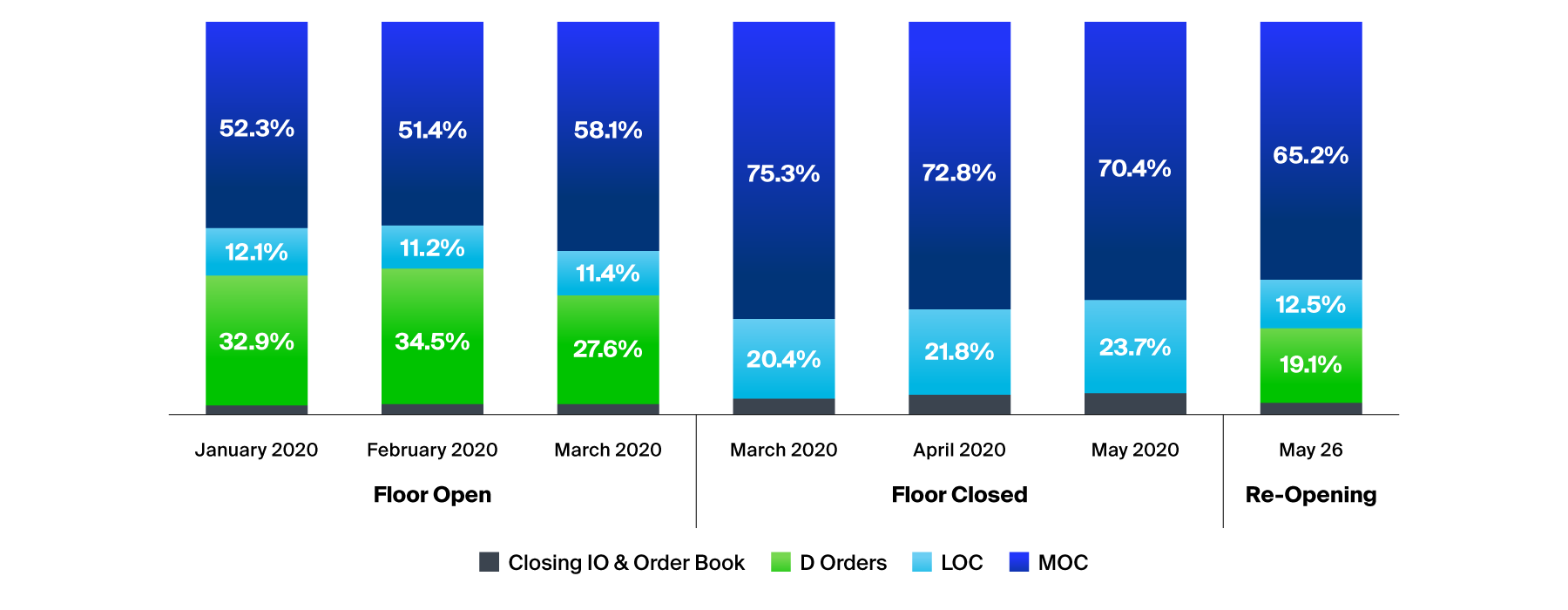

Dmm vs floor broker. But before the closing print because of system processing time the dmm should take this interest into account when formulating the close. However our understanding is that there are now more market and limit on close orders left unfilled which get canceled back to the buyer or seller who is typically an institutional customer. Floor brokers execute trades on behalf of institutional and high net worth clients. That puts other participants at a disadvantage making them less inclined to compete for queue priority which in turn can actually work against investors.

This can include more than one. But the order is not received by the dmm until after 4 00 p m. The floor brokers specialists and designated market makers dmms on the trading floor are the face of. They are independent members of the exchanges on which they trade and they work from physical trading floors.

The storied new york stock exchange in lower manhattan is a symbol of american capitalism.

:max_bytes(150000):strip_icc()/GettyImages-1195603075-7e8dc700af47458e9b4f03a91c1397d8.jpg)

/GettyImages-149260742-64d8d0b49a4c45478d54394afbfed905.jpg)

/USStocksOddLots20142019-e2f26380af114d4eae1b22248764bc70.jpg)

/MythsaboutWallStreet-c10a9cee9fc2496fb9da5b8150334f94.jpg)

/GettyImages-1027438182-1a28c6f99cbb45d990f5f041be23f622.jpg)