Deutsche Gold And Precious Metals Fund Fact Sheet

The index is a rules based index composed of futures contracts on two of the most important precious metals gold and silver.

Deutsche gold and precious metals fund fact sheet. Cef provides investors with exposure to both precious metals at a time when demand is very high and access is becoming more difficult due to disruptions in the global mining supply chain. The fund and the index are rebalanced and reconstituted annually in november. About the gold and precious metals fund. Franklin gold and precious metals fund fact sheet author.

1dbiq optimum yield precious metals index tr 2the s p gsci precious metals index is a world production weighted index consisting of two precious metals commodities in the world economy including futures contracts for gold and silver. The fund management objective strategy and risks also changed at that time. The gold and precious metals fund is the first no load gold fund in the u s. An active fundamental approach focused predominately on gold precious metal mining company equities trading at attractive valuations.

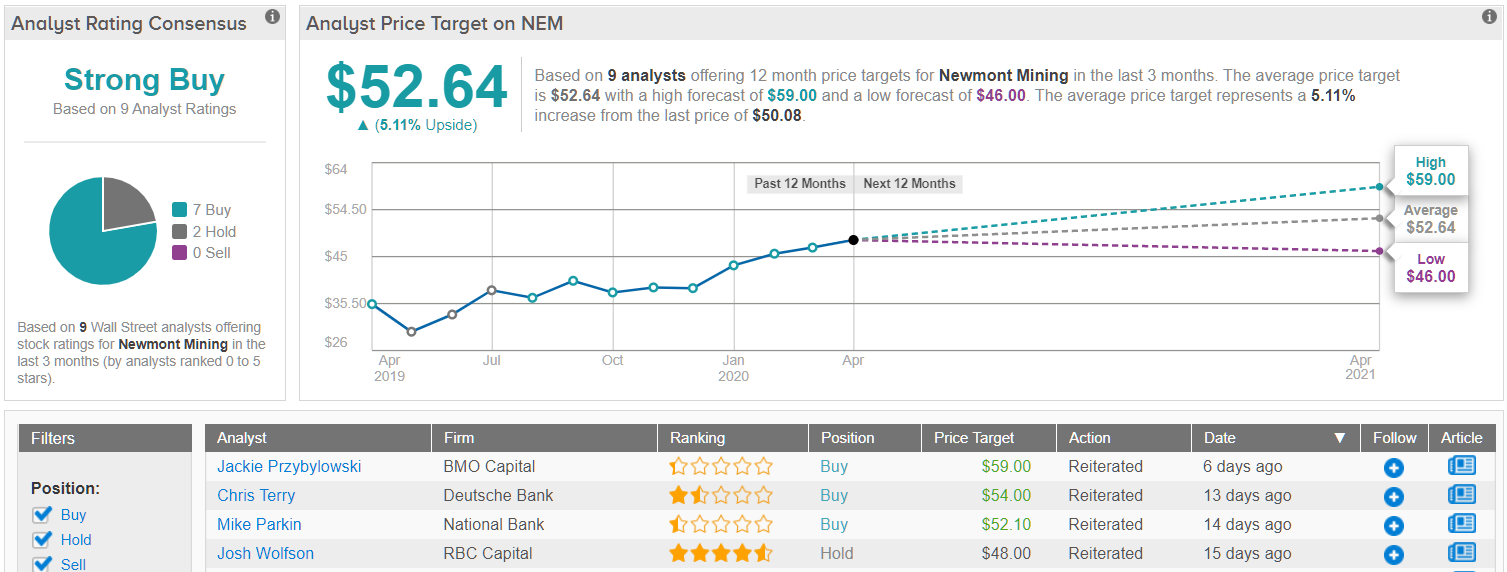

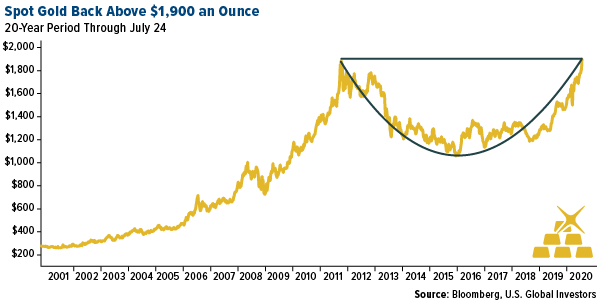

Gold and precious metals equities as measured by the s p bmi gold and precious metals index non sharia compliant gained 6 12 during the period. We have a history as pioneers in portfolio management in this specialized sector. The sprott physical gold and silver trust nyse arca. Morningstar rating overall rating equity precious metals category.

Gold etfs had net inflows of 2 78mm oz or about 2 8 of total known gold etfs. As of 08 31 2020 the fund had an overall rating of 4 stars out of 60 funds and was rated 5 stars out of 60 funds 5 stars out of 59 funds and 3 stars out of 47 funds for the 3 5 and 10 year periods respectively. A single page data sheet describing the franklin gold and precious metals fund s objective portfolio holdings and performance. Class a shares at nav march 31 2010 march 31 2020 invesco gold precious metals fund 5 538 performance of a 10 000 investment.

Cef currently holds approximately 1 442 million ounces of gold and 60 395 million ounces of silver. The strategy and management team also changed at that time. Prior to 9 23 19 this fund was known as dws mid cap value fund. Prior to 7 29 19 this fund was known as dws multi asset global allocation fund.

The fund is designed for investors who want a cost effective and convenient way to invest in commodity futures. Platinum was the only precious metal that had a negative return of 1 02. The fund s objective and strategy also changed at. January 05 2007 shares are not fdic insured may lose value and have no bank guarantee.