Depreciating Solar Panels Home Office

46 and 48 and a special allowance for depreciation under sec.

Depreciating solar panels home office. How do you properly depreciate solar panels if you have a home office. Count the number of rooms in your home. Based on pub 946 i would expect to see it on line 19b as a 5 year property with a higher depreciation deduction. Satisfied the requirements of then applicable sec.

The solar panels are a capital improvement. Depreciation on your home is deductible only if you use your home for business. Maybee i have a client who raises snakes in his garage we carefully track his electric consumption because his garage is about 2 3rds of his total home consumption and i deduct that amount. You can take a 30 credit and depreciate 85 of the cost of your solar energy panels.

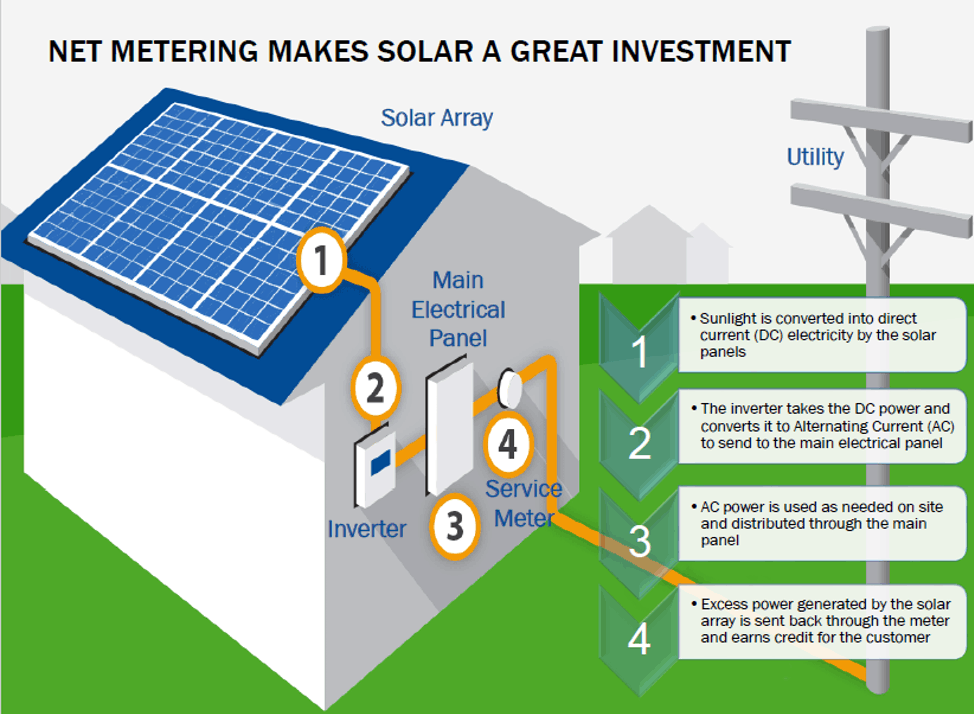

The ratio of the two will yield your home office percentage. Specifically for solar panels how much of the homes electricity expense is consumed by the home office. If you began using your home for business before 2016 continue to use the same depreciation method you used in past tax years. You can deduct 15 of the depreciable portion of the property as part of the home office deduction.

To take this you would have to fill out that form yourself and print and mail your return with that form attached. You can deduct 15 of the depreciable portion of the property as part of the home office deduction. Established a basis in solar panels and related equipment for purposes of claiming an energy credit under secs. Had sufficient amounts at risk under sec.

Depreciation on solar panels is one of the easiest ways businesses and farms looking to go solar can keep installation costs down rois high and paybacks short. Is it proportional to square footage. Figuring the depreciation deduction for the current year. You d have to depreciate the solar on the same 39 year straight line schedule as the house itself.

The tax cut and jobs act of 2017 brought with it the option for 100 bonus depreciation on solar systems which is often a great way for businesses to quickly recover costs associated with integrating solar energy. Turbo tax automatically assigns a 39 year recovery period but per pub 946 it should be 5 years. If you use part of your home as an office you may be able to deduct depreciation on that part based on its business use. The solar panels are a capital improvement.

Your home office percentage will be one divided by the number of rooms you have. The land value is never depreciated so you ll have to break that out separately. You can claim 20 of your home s expenses if your office takes up 20 of your home s total space. The home office solar panel depreciation appears automatically as a 39 year property on part iii line 19i on form 4562.

:max_bytes(150000):strip_icc()/GettyImages-1144567782-3ac4fcfec3c94cfdb71b363dce6e1394.jpg)